BMW Motorrad set another record year of sales in 2015, seemingly along with all the European motorcycle manufacturers (Husqvarna, Ducati, & KTM). BMW quotes that 136,963 motorcycles and maxi-scooters were sold last year, and thankfully the Bavarian brand is fairly forthright with its sales data.

This allows us to make some interesting points of observation about BMW Motorrad, the most potent of which is the brand’s success in the sport bike market, which accounts for 16% of all BMW motorcycles sold last year.

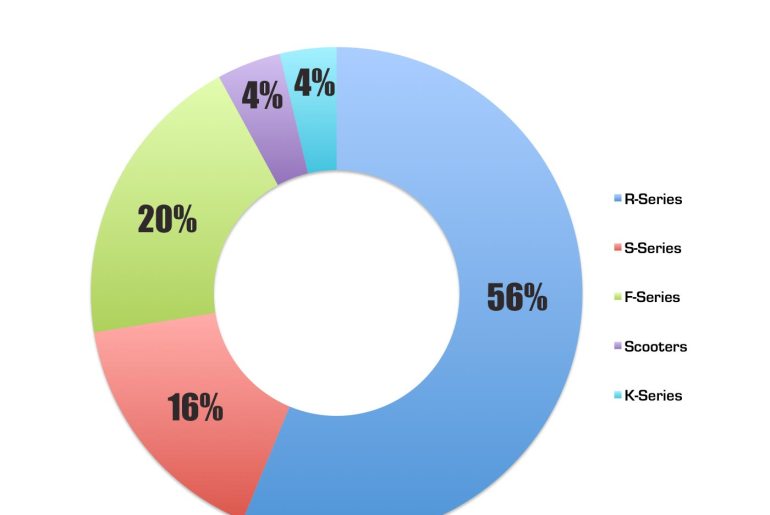

Equally interesting is the fact that BMW’s boxer-engine machines, the R-Series, accounts for over half of BMW Motorrad’s sales (see the chart above) – a strong signal to the power of BMW’s iconic past.

This shouldn’t be too surprising, especially when you look at the breakdown of sales by model (table below). Of BMW’s Top 5 motorcycles sold last year, the R-Series accounts for four of the models listed (R1200GS, R1200GSA, R1200RT, and R nineT).

Furthermore, the R1200GS models, when combined, account for nearly one-in-three BMW motorcycles sold worldwide. That is a staggering number, and few motorcycle models 500cc and above can come close to making such a statement.

Rank Order of the 2015 BMW Motorrad Models:

| No. | Model | Units Sold | % of BMW Sales |

| 1 | R1200GS | 23,681 | 18.2% |

| 2 | R1200GS Adventure | 18,011 | 13.8% |

| 3 | R1200RT | 10,955 | 8.4% |

| 4 | S1000RR | 9,576 | 7.3% |

| 5 | R nineT | 9,545 | 7.3% |

| 6 | R1200R | 6,951 | 5.3% |

| 7 | F800GS | 6,603 | 5.1% |

| 8 | S1000R | 6,473 | 5.0% |

| 9 | F700GS | 6,282 | 4.8% |

| 10 | F800R | 5,971 | 4.6% |

| 11 | S1000XR | 5,061 | 3.9% |

| 12 | K1600GT/GTL | 4,866 | 3.7% |

| 13 | C650GT & C600 Sport | 4,530 | 3.5% |

| 14 | R1200RS | 4,208 | 3.2% |

| 15 | F800GS Adventure | 4,129 | 3.2% |

| 16 | F800GT | 2,631 | 2.0% |

| 17 | C Evolution | 957 | 0.7% |

As you can see, the only non-R model to squeak into the Top 5 was the BMW S1000RR, which was moderately updated for the 2015 model year. The model was BMW Motorrad’s top-seller in the US market, and if you believe BMW UK, it was the best-selling superbike worldwide in 2015.

We wouldn’t mind being able to double-check that figure against sales for the Yamaha YZF-R1, as it outsold the S1000RR in the US market by roughly 50%. But still, BMW selling almost 10,000 units of the S1000RR superbike is an impressive figure. For reference, it easily surpasses Ducati’s combined sales of the 1299 and 899 last year.

Also of note are the sales of the BMW S1000R, which accounted for 5% of BMW sales with its roughly 6,500 units sold.

This data should help dispel the myth that streetfighter models don’t sell (this is the model’s second year of sales), though we wouldn’t mind seeing the breakdown of sales by region. We suspect most of those S1000R sales occurred in Europe, and not the USA.

It’s Not All Roses

While these models help write the narrative about BMW’s sales prowess, the BMW S1000XR paints a different story. Selling just over 5,000 units, we would have thought that the S1000XR would have been a bigger seller for BMW, especially in its maiden year.

We should perhaps temper that notion with the fact that the BMW S1000XR was a late arrival for BMW dealers, especially here in the USA, where ADV bikes sell quite well.

As such, we would expect to see the S1000XR to climb BMW’s sales ranking over the course of 2016, as the model could easily be a Top 5 contender.

BMW’s other new bike for 2015 was the BMW R1200RS, which also was a poor performer. The fourth worst-performing model in BMW’s lineup (from the data we have, which as will point-out in a minute, isn’t entire complete), the BMW R1200RS sales are perhaps not a surprise to anyone who has ridden the machine.

Too slow and heavy as a sport bike, and too uncomfortable as a tourer, the sport-touring models is a compromise of two divergent goals. We imagine that there are some diehard wasser-boxer fans that will like the machine, and we suspect that there are roughly 4,000 of them worldwide.

Of course, like the S1000XR, the R1200RS didn’t get a full-year of sales in 2015, so expect it to perform better next year…just don’t expect it to perform that much better.

An interesting bookend to BMW’s model lineup, our last comment is for BMW’s maxi-scooters and its premium touring models, the K1600GT & K1600GTL – both of which account for 4% of BMW Motorrad sales.

We should point out that for whatever reason, BMW doesn’t breakdown its K-Series sales by model, so we should point out that the K1300S is included in that figure. We suspect the folks in Berlin don’t want to let on that its supposed flagship model isn’t actually a strong seller, but that’s only a guess.

The last thing we should point out is the roughly 400 unit discrepancy between BMW Motorrad’s quoted sales figure, and what the company is report at a more granular level. The only explanation we for the missing units is that they belong to the BMW G650GS, which BMW omitted from its data.

For the Future

For 2016, we expect to see the R-Series to account for even more BMW Motorrad sales, especially with the R nineT Scrambler hitting dealership floors.

Judging from the strong sales by the R nineT base model, the Scrambler variant should be quite strong; and more importantly, it should bring in a younger demographic to BMW.

Along that same vein, we expect to see the G310R to bring in a number of new riders, many of whom will be younger than BMW’s core demographic. It is very possible that the BMW G310R could be a Top 5 model for BMW, thus adding more diversity to BMW’s rank-order. Time will tell, of course.

2015 BMW Motorrad Sales by Series/Model:

| BMW Motorcycles Series | Units Sold Worldwide |

| R-Series | 73,357 |

| R1200GS | 23,681 |

| R1200GS Adventure | 18,011 |

| R1200RT | 10,955 |

| R nineT | 9,545 |

| R1200R | 6,951 |

| R1200RS | 4,208 |

| F-Series | 25,616 |

| F800GS | 6,603 |

| F800GS Adventure | 4,129 |

| F700GS | 6,282 |

| F800R | 5,971 |

| F800GT | 2,631 |

| S-Series | 21,110 |

| S1000RR | 9,576 |

| S1000R | 6,473 |

| S1000XR | 5,061 |

| Scooters | 5,487 |

| C650GT & C600 Sport | 4,530 |

| C Evolution | 957 |

| K-Series | 4,866 |

Source: BMW Motorrad

Comments